Political vs. Polemical, Anecdote Circles and My Brain on Journaling

Is it getting hot in here or is it just me? Knowing the difference between political and polemical boils down to taking the temperature in the room.

Polemical vs. Political

Anecdote Circles: A New Way to Know Your Customers & How They Solve Traditional Research Problems

When looking at customers through a nuanced, holistic lens, traditional methods of data collection can miss the mark. All of these methods have their benefits, but also significant drawbacks. Let’s take a look at some of the most often used approaches.

Focus Groups

This is a traditional marketing fave, where small groups who are curated to meet specific “qualifications.” They may be people who do/don’t already shop with you, or they may be parents, or single, or whatever key demographic that’s important to your brand, product or company.

There’s something satisfyingly voyeuristic with this method. A moderator sits in a room with the focus group attendees, while representatives from the company sit behind mirrored glass. You can see in, but the participants don’t know you’re watching. You can ask participants very specific, pointed questions, and share physical or digital stimuli to gauge their reactions. Typically, the moderator compiles a report following the focus groups, which may or may not actually be read. I’ve attended many a focus group throughout my career, and the overwhelming takeaway usually feels something like, “Well, that was interesting.” And then everyone moves on, and nothing much changes.

My main takeaway from attending a decade’s worth of focus groups: “Well, that was interesting.”

One-on-One Interviews

Deep and wide-ranging, intimate conversations between a trained researcher and one or two customers are incredibly revealing. I recently watched interviews of parents and their teens in preparation of the design of a new joint-checking account designed for parents and teens. Similarly, I watched a highly emotional conversation with an aging parent and her adult son as part of the product design process for a caregiver banking account. This more intimate set-up encouraged a two-way conversation that you don’t really get in a focus group.

Watching these intimate conversations often makes me laugh or cry (OK, both sometimes).

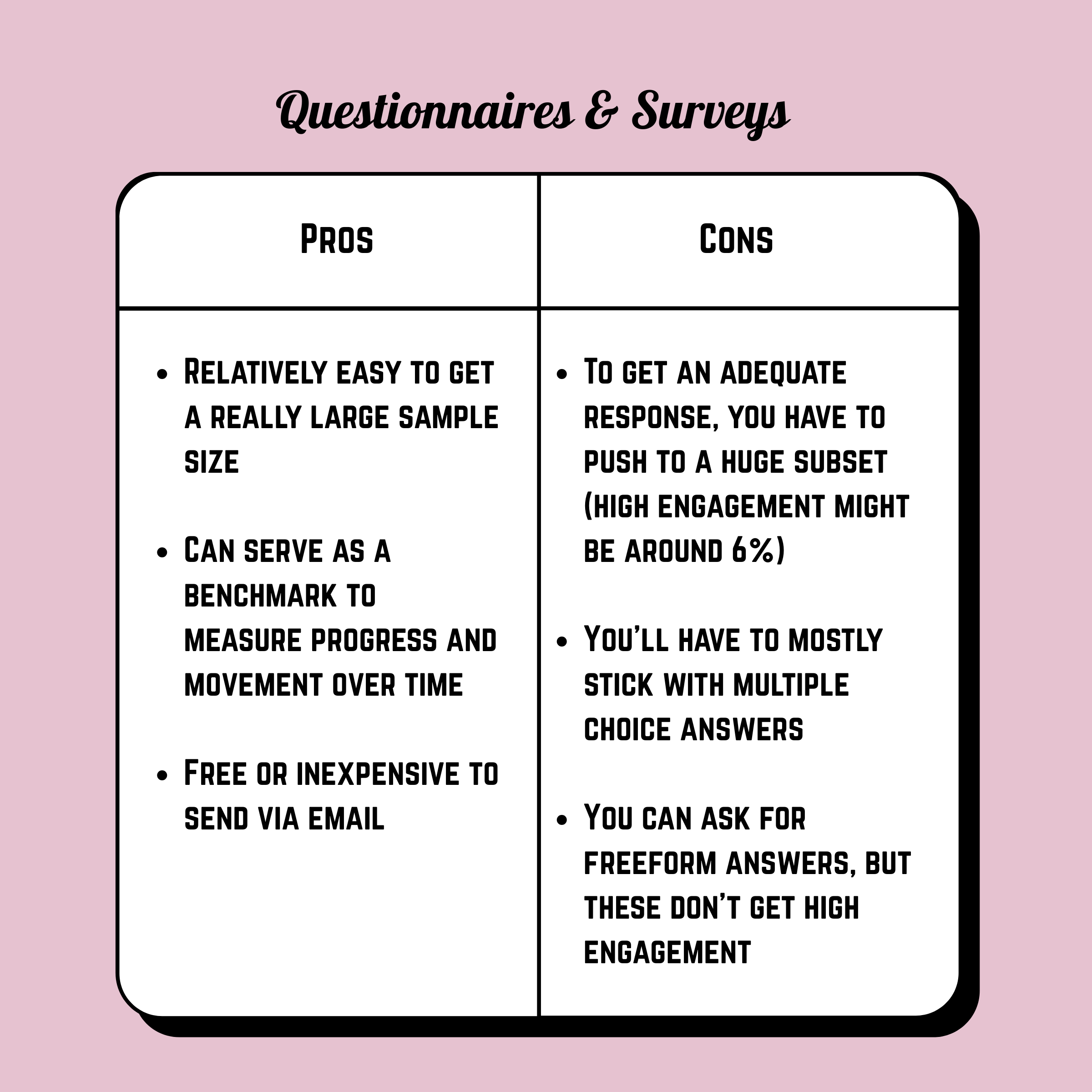

Questionnaires & Surveys

Having a pool of people answer the same set of questions can be extremely helpful, especially if the goal is more measurement than research. You can repeat surveys and questionnaires at pre-determined intervals to establish benchmarks to check against. This is a similar approach to the methodology used by pollsters, and I’ve seen it work well to collect narrow data, especially on slippery questions of “perception.” As in, do you perceive that our meat and produce are fresh? Do you perceive that you are receiving advice and guidance from us on your finances?

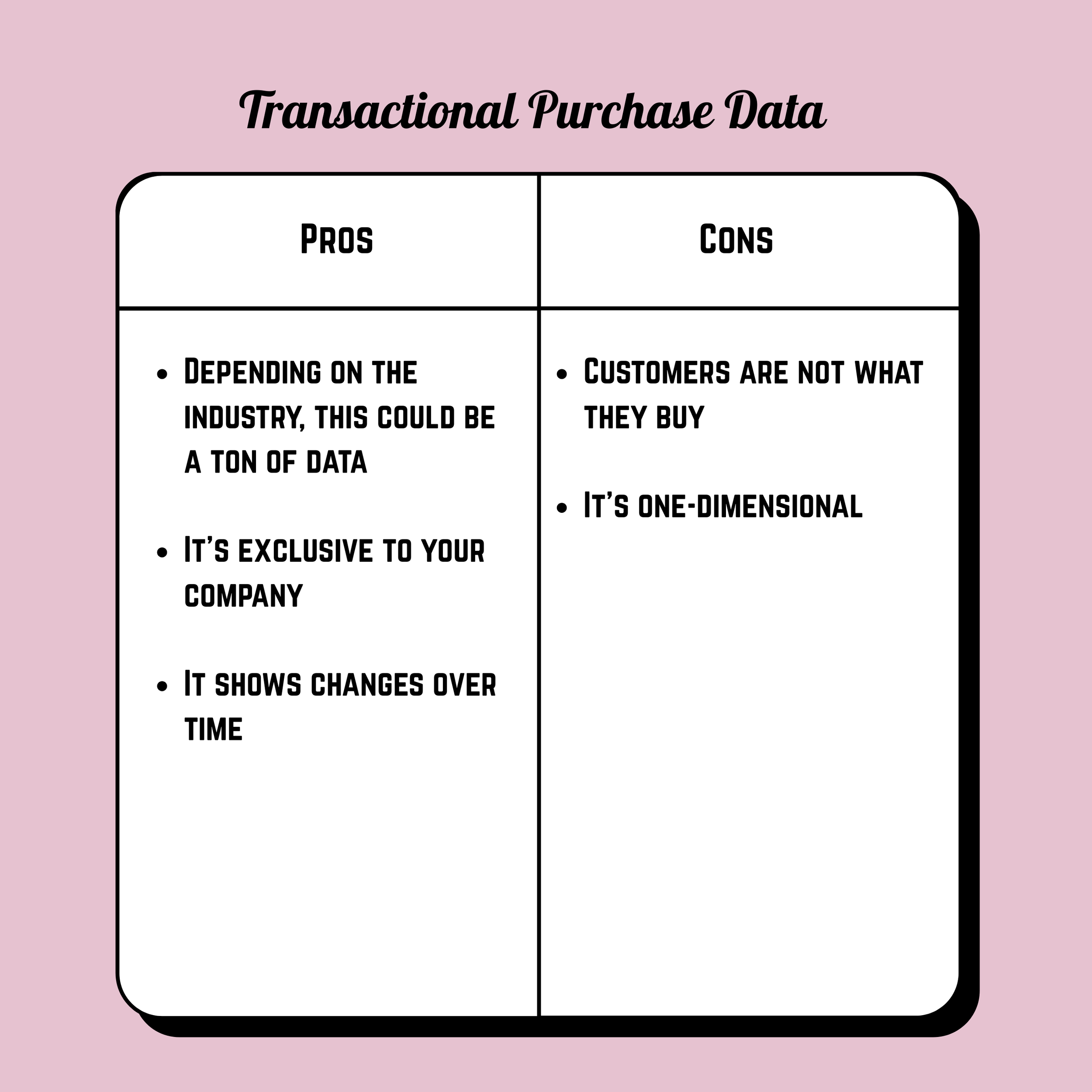

Proprietary Transactional Data

Data that your customers give you or that you track about their behavior is an extremely rich source of information that’s reliable and informative. Just remember that customers are not what they buy. That is one aspect to consider, but it doesn’t provide a complete picture. More tellingly, what conclusions can you draw based on the types of purchases they make over time?

To build on this data, you have to keep it clean and accessible, and mine it for insights and stories to inform your messaging strategy.

Third-Party Data

Most companies cannot paint a complete picture of their customer with just their proprietary data. The answer is often to bring in third-party data from companies like Nielsen and IXI. This data can supplement the information you already have to bring your customers into sharper focus.

Not One, but Many

Ideally, you would not rely on any one of these methods alone, but braid together a mix to get the most detailed and realistic snapshot possible. Additionally, as the world and those living in it change, it’s essential to talk to customers on a consistent cadence. Listening to customers is an ongoing commitment, not a box to check once when you’re creating a new product or embarking on a rebrand.

Anecdote Circles Offer Scale by Mixing Quant & Qual Data

A newer alternative to the traditional methods of gathering inputs from customers is called anecdote circles, which is essentially a way of collecting narratives at scale and mining them for common themes, insights and unknown customer problems and pain points.

The Best Medicine for Anemic Sales at Pfizer

Former Communications Director at Pfizer, Nigel Edwards, wrote about using this method in the publication Strategic Communication Management in an article titled “Using stories to increase sales at Pfizer.” His use case was not with customers, but to gather stories from a 900-person international sales force spread through 11 different countries. Their objective was simply stated yet daunting to answer: “… [to] gain a clear understanding of the sales force, their strengths and weaknesses, their experiences and perceptions of the sales environment they worked in. Second-guessing the issues was likely to be, at best, counter-productive.”

They considered and rejected all the traditional methods listed above. On focus groups: “…we were concerned that focus groups tend to become a battleground for opinions – and only the most dominant opinions survive.” Further, they “…recognized the human tendency to filter out examples that contradict strongly held opinions…”

Questionnaires and surveys were also problematic. “Direct questions wouldn’t have given us the underlying belief patterns that we needed to understand the complex journey. We wanted the real life context of the sales force. We wanted people’s day-to-day experience and lots of different perspectives on that experience – from there we would be able to get a better picture of the overall situation.”

Finally, they settled on a narrative approach that actually solves many of the pain points listed here. Unlike focus groups and interviews, it’s scalable. In contrast to questionnaires and surveys, it’s open-ended and invites unvarnished storytelling. While it is its own type of data, it isn’t metrics in a vacuum like typical purchase data (amounts spent, products bought, purchase frequency, but with none of the whys, whats and wherefores). Finally, it’s executed in a peer-to-peer organic social environment, as opposed to artificially created with a moderator or an interviewer in a strange room.

Here's how it worked for Pfizer. “The route we took then revolved around a simple process, but with a single twist to it. We would collect stories and narratives from the core audience, but use ‘signifiers’ to allow them to show us what those stories meant. This was crucial—we needed to make sure that experts elsewhere in the company didn’t re-interpret the stories. A set of signifiers would be built for the project and then these would be translated into the different languages. This would allow us to analyze the stories without having to translate them all first…”

Let’s Get Together

Over a two-week period, they set up a series of in-person social events, inviting salespeople who worked in the same region to share stories about selling this drug class in small groups. Anyone who wanted could share a story. After each story, all group members filled out a simple sheet with the named story and pick the “signifier,” similar to a keyword or theme, that best matched their understanding of that story.

Interestingly, these anecdote circles are social events designed to be as natural as possible, so people feel welcome and safe to speak freely and openly, without self-implied pressure to supply the “right answer.” As mentioned above, there is no facilitator or moderator directing things. Each small peer group self-directed the experience.

With their knowledge and consent, all the stories were recorded. In this instance, there were multiple languages spoken across different countries, and the events were tailored to meet cultural expectations of the different participants. For example, in southern Europe, the agenda included smoke breaks. Many of the events were catered. They were all unique to match the specific cultural norms of the place where they were held.

Spinning Stories into Data Gold

Pfizer contracted a third-party group called Narrate to help design the events, record and translate all the stories into English, transcribe all the stories and help mine them for common themes and insights.

The result was a treasure trove of narratives from a very diverse population. “… at the end of the two weeks, we had seen 94 sales representatives across 11 cities and collected almost 200 stories. More importantly, we had 1,700 different perspectives on those stories, giving us a clear picture of how the sales force viewed the product and the experience of selling it.”

Effectively, this method takes a qualitative input and transforms it into a quantitative data set. It would take far longer than two weeks to conduct focus groups with 90+ people, and it’s also a number you would almost certainly never reach with one-to-one interviews. Using the “signifiers,” or being able to tag the stories they did collect with insights from the other observers in the group also significantly multiplied the impact.

“It was also obvious that, by signifying their stories, the sales force was giving us more information than they realized – at no extra effort or cost. The subsequent analysis gave us insights no other method would have.”

The Method Was Part of the Cure

Interestingly, the researchers discovered a felicitous side effect they had not expected nor anticipated. The events themselves were seen in a very positive light that made participants feel connected, seen and heard. “… our diagnostic event was a positive engagement intervention in its own right… sitting in on some of the sessions myself, I could see how cathartic the process was.”

To the team at Pfizer, the results of this methodology were invaluable. “The first step – looking at the overall patterns that emerged – started to show useful conclusions immediately. From this, we could see that while we had thought that product knowledge was the most important element, it was secondary to the sales rep’s attitude. Indicating that, while we needed to ensure that their product knowledge was good, we would derive greater benefit (and sales revenue) from focusing on their attitude.”

One bonus of the narrative approach is that, “Where new content was needed, examples were already available in the stories – stories of failure to share and learn from, successful examples for the communication team to disseminate.”

A key finding that surprised everyone caused a shift in the way Pfizer trained its salesforce on this particular drug. “One issue that became clear was that sales representatives saw the most difficult part of the sales process was handling customer objections. This was understandable given the complex history and high market visibility of the product and its class of medicines. We were able to identify 18 stories strongly indexed to objection handling seen by reps as being either positive or strongly positive. These stories were then translated and used in the briefings around the new clinical study data for the sales reps.”

The data collected was mixed in that some of it confirmed what the researchers thought, and some of it was the complete opposite. This is why getting your own data and analyzing it objectively is of such tantamount importance.

Here’s one example that disproved a widely held assumption: “Sales representatives who had started before the problem with the overall class of drugs were less defensive than those who joined later. This was the opposite of what we’d expected. We had anticipated that those who were around at the time would be more negative, but in fact they remembered what it had been like before and that the problem was with the class of drugs, not our product. People who joined later had been swamped by the negativity of this time. We’d have struggled to find this out by another route.”

Taking Action on the Results

Pfizer used the data to inform the plan and agenda for a massive event with more than 900 sales representatives from across Europe. They ran sessions on targeting, objection handling and attitude. “We invited customers – both doctors and patients – to talk about their experiences of prescribing and taking the drug. This was a major departure from our usual approach of presenting scientific data. (Of course, the data was presented but not as the primary focus of the summit.)”

Furthermore, much of the material for the summit had already been created via the narrative collection process. “Content for the event came from the stories themselves, making it easier for the communications team. Each country now has available a set of all the stories in that area – a real asset as they look to improve results in their geography.

The summit also gave sales representatives a much greater sense of control over their own destiny – better results were available through their own actions, not waiting for the organization to cure their problems. They now feel that there is a lot to be gained for doing a few notable things – all easily within their grasp.”

Anecdote Circles Curated for Customers: the Power of Stories at Scale

Imagine translating this process to gather rich, nuanced, contextualized stories from hundreds or even thousands of customers. The events themselves would engender positive feelings toward your brand, company and product. And the collected narratives would offer an unbelievable source of insights into the inner workings of individuals previously out of reach.

I wonder – what assumptions that we as marketers make about our customers would be proven wrong? What new nuggets would be uncovered that would drive innovative, customer-centric brand expression, value propositions, new product development? Imagine having real customer verbatims to include as part of a strategic marketing brief. Or being able to pull from a growing library of real life stories, validated by peer groups.

The power of stories at scale has the potential to revolutionize marketing because it would allow marketers to viscerally understand the most prevalent worries, mindsets, habits, pain points and dreams of the actual real people who are their customers.

My Brain on Journaling

Since January of this year, I’ve been writing in a journal almost every day. Usually it’s just 15 minutes in the morning as I sip a cup of coffee. I’m now halfway through my FIFTH journal, which is almost completely unbelievable to me. What do I write about? Whatever I want! There are no rules. Mostly I capture what’s on my mind or what that day is like, switching between colorful ink pens. Occasionally, I draw (mostly animals) or add in random stickers or paste in my kids’ artwork. The truth is, writing in my journal is intensely pleasurable. I don’t do it because I have to, or I should, or because it’s healthy. Rather, it’s a ritual I revel in.

Sometimes if I have a vulnerable nugget of a hatching idea, I start out with it in my journal because it’s an extremely safe and non-judgmental space. No one else is going to see it, and if it’s shit, well then so be it. Recently, I read Ray Kurzweil’s book How to Create a Mind. In it, Kurzweil discusses the biological machinery of memory and consciousness, a delicate and ephemeral process. Yes, your brain takes in a multitude of details, processes vast troves of information—and then promptly forgets most of it. One example he gave stays with me. He wrote about going for a walk, and how he passed a few people along the way, but only recalled details about one particular woman with a baby who reminded him of his own daughter and grandchild. In writing about the pair, he acknowledged, he was cementing their details in his memory far more permanently and firmly than if he had kept them only in his mind’s eye.

Yes, that’s right. Capturing a moment in writing extends its life. Since reading that tidbit, I’ve been intentionally writing down little vignettes I want to keep close. I’ve always found my memory a bit holey and unsatisfactory—unreliable traitor! But maybe I can hold memories a bit more securely by taking note.