Sanguine vs. Sangfroid AND How to Write Your Customer’s Story

OK, I’m pulling out some serious 50-cent words here. As a general rule, I happen to believe you can communicate meaningfully with plain language wielded well. But sometimes there’s something so satisfying about weaving in a shiny impressive word with just the right meaning. See if you can pick the words in the right order. They share a root that has to do with blood (sang), but that’s where the commonality ends.

Sangfroid vs. Sanguine

Can You Write Your Customer’s Story?

Can you tell an engaging story about one of your customers? No, I don’t mean a persona. Nor do I even mean a customer verbatim or testimonial. What I mean is this: Fire up your imagination and spin a vivid, detailed tale about a particular customer who could exist, who maybe does.

Let Me Tell You a Story

Earlier this year, I gave a presentation about a suite of new banking products. As I spoke, I told stories about the very real, struggling, striving individuals who I imagine can benefit from these products. In my mind’s eye, these are people whose lives will be changed, and even transformed, through their usage of these products.

I added descriptive elements from my own personal experiences. When I shared how a Caregiver with access to a loved one’s account could block certain vendors, retailers or categories, I related how meaningful it would have been to me to block JTV when my mom was early in the disease process with Alzheimer’s. When I talked about Sharing with Others, which allows account holders to invite anyone of their choosing to view their account and help them stay on track financially, I imagined a grown-up version of my kind and responsible oldest son helping out one of his younger sisters so she didn’t miss her bills when she’s starting out on her own.

After the presentation, four meeting attendees separately expressed how much they had gotten from how I spoke about the banking products. What they were specifically responding to was my storytelling. In speaking about potential customers as real people, with distinct character traits, peculiarities and multi-dimensional relationships, I instantly brought the banking products to life in a way that was imminently understandable and relatable.

In this example, the stories I told were actually no more than vignettes, little snippets studded with vivid details. If you take the time to flesh out these stories, to walk through a day or a month or years with an imagined person, you’ll uncover stunning insights because you will inherently understand that a potential customer is not walking around thinking about what to buy from your brand. Their to-do lists are staggering, their mental load over-loaded. You don’t even rate a thought on most days. In walking with these real people, what would you say to them? What message might resonate? What content might be helpful? What positioning would break through the fog?

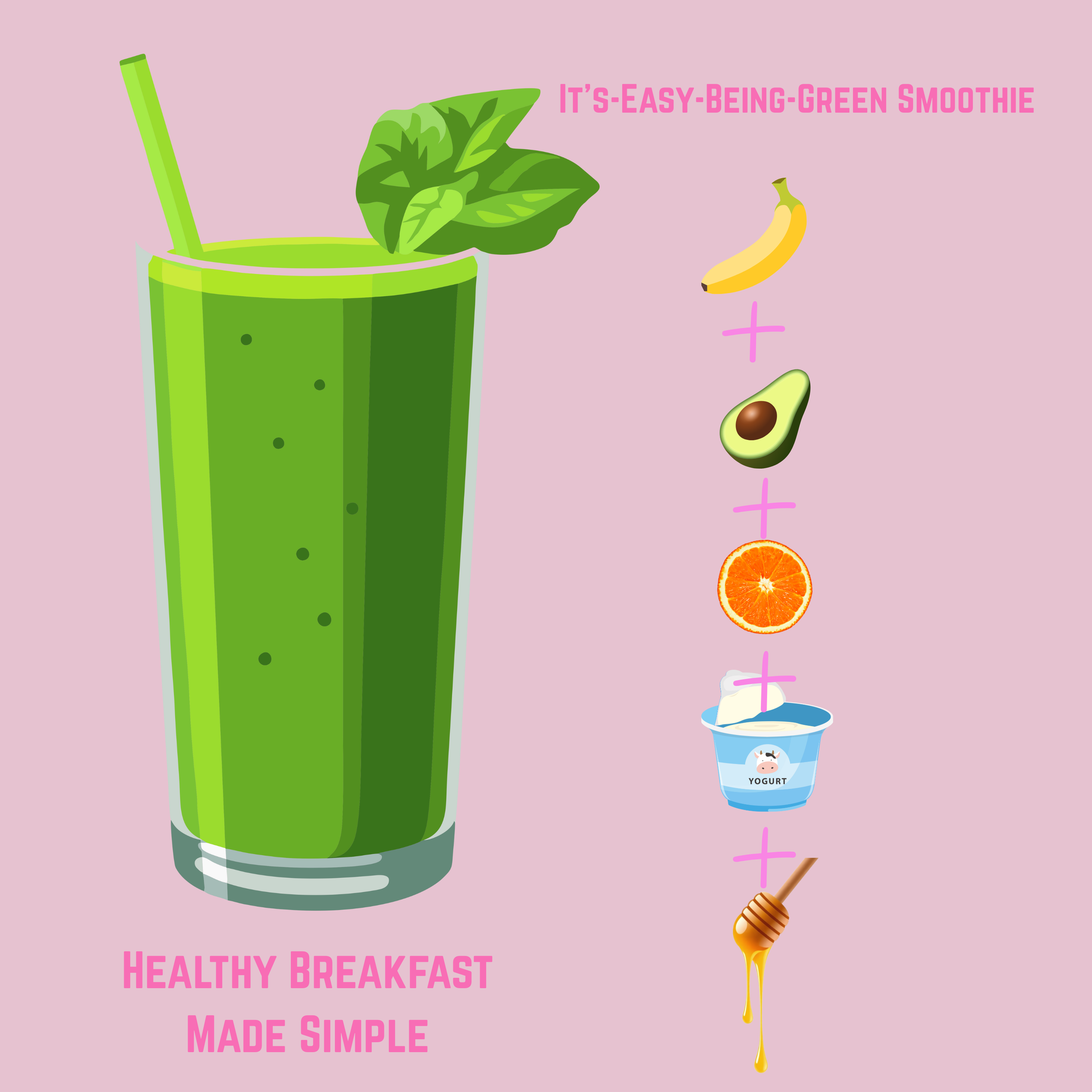

This approach is product-focused. It’s effective while the bananas are on sale.

Showing a healthy smoothie solves breakfast, makes banana buying a habit, doesn’t require a sale and also gets multiple additional items added to the cart.

Finding the Universal Via the Individual

Here’s a secret shortcut to imagining a customer’s story. Flip through your mental rolodex and find a real person you actually know reasonably well who might be an ideal customer for your brand or product. Think about what you know about their life, their pain points, their journey, their perspective on life. Now hold them in your mind’s eye as you design strategy and write copy. What you create will feel infinitely more personal because you are making everything for that particular person. On the flip side, what feels personal often has universal appeal. If you can tap into the core of what makes a human-to-human connection, you’ll end up with marketing that is deeply empathetic, human-centered and feels good.

Living with our customers’ stories isn’t always easy, and it doesn’t always come naturally. Our company stories are often louder, more urgent. “Sell more bananas!” I remember the Head of Sales at Kroger chanting at a massive all-company meeting with so many attendees it was held at the Cincinnati Convention Center. Every week, we look at sales numbers, conversion rates, engagement metrics. Leaders spur us to heed the figures, DO SOMETHING to change the trajectory, make sure we’re on track for the quarter, the year.

Stop Thinking It’s Your Fault

When something doesn’t work as expected, we’re quick to blame ourselves. Maybe our user experience is confusing? Was there a tech outage that could explain a sales dip? Was there a blizzard on this day a year ago? Could we cut out some clicks so people don’t abandon the sign-up process halfway through? Marketing! Get marketing in this meeting! What can marketing do? Of course, those questions are worth asking and answering. But most times, the “problem” is not one that can be solved by a smoother experience or a digital solution. Not even a coupon or a promo always moves the needle. It’s just life, getting in the way.

In the midst of all the noise, the weekly ups and downs, the steady marketer’s magic trick is to keep our gaze fixed fully on the customer. What are their pain points? And how can we help?

In a best-case scenario, you yourself are a potential customer. If that’s the case, think through your own pain points as they relate to your product or brand. Better yet, write it all down. Then find ways to weave your story into meetings. If you’re not the customer (unfortunately, I don’t know what it’s like to be one of our Wealth customers, for example), think of someone you might know who does fit the bill. If not, read about that demographic, talk to others who do regularly interact with them. In the specific case of Wealth customers, our financial advisers are an incredibly rich resource (pun intended). Ask for details. Then again, employ your powers of imagination. Just because someone is a multi-millionaire does not mean their life is constant smooth sailing. They have pain points, too. Imagine their headaches, fears and frustrations.

In some cases, even if you aren’t a potential customer now, maybe you were at some point in your life. I had barely any money in my 20s, so I can very vividly remember what it was like to live paycheck-to-paycheck, for example. Wind back the clock and recall the troubles you faced in as much detail as possible. Recently, I’ve had conversations with many people who recall how difficult it was to transition into adult financial independence. Groceries cost what? Apartment deposit, huh? Car insurance? It’s a rude shock for most of us, as there is a lack of support and education from being wholly taken care of by one’s parents into a realm where you’re expected to figure it all out and function in the world largely on your own. Now think of the opportunity for a bank to step in here and be extremely helpful, not just with thoughtfully designed products and user-experience features, but with content and messaging that supports the shift into financial independence, growing into true freedom and confidence.

Ready to talk content strategy? Email me at jessica@pinkpineapplepost.com or DM me on LinkedIn.